Worldline Payment Interface

Version 2.2.2

Table of Contents

1. Introduction

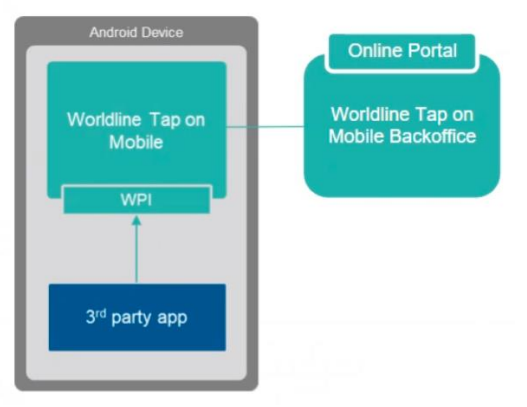

This page is intended for third-party application providers who want to develop business applications for Worldline Payment Applications. This document only covers use cases for the Worldline Tap on Mobile.

To interact with a payment application, Worldline has defined the W orldline P ayment I nterface, also known as WPI . WPI is designed for easy and fast integration. A 3rd party application is used to extend and control the business flow for the desired use cases. The payment application is only displayed in the event of a transaction.

The transaction flow and screens cannot be changed due to the payment protocol and PCI requirements.

All source code examples are written in Kotlin (Android).

1.1 Supported Transactions Types

At this stage the following transaction types are supported:

Payment

Refund

Reversal/Cancellation

A Reversal transaction can only be used for the last successful purchase transactions (Payment).

A Refund transaction can only be used for successful purchase transactions (Payment) that cannot be Reversed/Cancelled.

1.2 Preconditions

Before you can start the implementation, you must meet the following preconditions:

Development IDE for Android development

Android Toolkit

Worldline Tap on Mobile Sandbox App

Fully available android application project

Your package name has to be whitelisted for Tap on Mobile app

1.3 Versioning

Every WPI version Y.X is backward compatible with all Y versions. A payment solution who has implemented version 1.1 can be used with request in version 1 (1.0) format. A Version 2.2 cannot be used with a request with version 1.1.

Tap on Mobile support:

ID |

Tap on Mobile Version |

WPI 1.0 |

WPI 2.0 |

WPI 2.1 |

WPI 2.2 |

|---|---|---|---|---|---|

1 |

2.1.25 |

Ok |

N/A |

||

2 |

2.1.25.1 |

Ok |

N/A |

||

3 |

2.1.28 |

Ok |

N/A |

||

4 |

2.1.28.1 |

Ok |

N/A |

||

5 |

2.1.29 |

Ok |

N/A |

||

6 |

2.1.30 |

Ok |

N/A |

Ok |

|

7 |

2.1.31 |

Ok |

N/A |

Ok |

|

8 |

2.1.32.X |

Ok |

N/A |

Ok |

|

9 |

2.1.34.X |

Ok |

N/A |

Ok |

|

10 |

4.1.39.x |

Ok |

N/A |

Ok |

Ok |

11 |

5.3.0 |

Ok |

N/A |

Ok |

Ok |

12 |

5.4.0 |

Ok |

N/A |

Ok |

Ok |

2. Communication Layer

2.1 Android Inter App Communication

WPI is using Intents in Android that are a means of communicating between components of an Android app, such as between Activities, Services, Broadcast Receivers, and Content Providers. An Intent object is used to describe what an app component should do, including the action to be performed and the data to be used.

Intent usage in Android for application integration can be broadly categorized into two types:

Explicit Intents: These intents are used to launch a specific component within the same app. The target component is specified explicitly in the intent. For example, starting an Activity from another Activity within the same app.

Implicit Intents: These intents do not specify the target component directly. Instead, they declare a general action to be performed and let Android resolve the target component based on the information provided in the intent. For example, sending an email or opening a web page. WPI is the implementation of this type of intent.

Intents can also carry data in the form of key-value pairs, called Extras, which can be used to pass data between components. By using intents, apps can delegate tasks to other components and take advantage of the existing Android framework to perform common actions.

2.1.1 Interface Structure

The WPI provides a set of intents that developers can use to build apps that work with the interface. The following table lists each intent, along with its purpose:

Type |

Category |

Intent |

Purpose |

|---|---|---|---|

Financial |

Display Action |

com.worldline.payment.action.PROCESS_TRANSACTION |

Process a financial transaction |

Information |

Background action |

com.worldline.payment.action.PROCESS_INFORMATION |

Background management of payment solution specific information |

We have two type of categories for the Interface

Display Actions : These actions start the payment solution that are processing financial transactions or require user interaction.

Android intents are used

Background Actions : These actions perform background processing that doesn't require user interaction, but sometimes can require user interaction (due to COTS device specification).

Android intents are used

2.1.2 Android Intent implementation

The start of a payment is based on an intent. Each special transaction type has a set of parameters that are mandatory. To test transactions, you can use the Worldline Tap on Mobile Test App.

val intent = Intent("com.worldline.payment.action.PROCESS_TRANSACTION").apply{flags += Intent.

FLAG_ACTIVITY_REORDER_TO_FRONT}This intent requires some extras:

Request

Extra |

Description |

Type |

Condition |

|---|---|---|---|

WPI_SERVICE_TYPE |

Specify the subtype of action to be executed |

String |

Mandatory |

WPI_REQUEST |

The request contains JSON structured data mandatory for given service type, in some specific cases this field is not given or empty |

String |

Mandatory |

WPI_VERSION |

Used WPI version |

String |

Mandatory |

WPI_SESSION_ID |

Used as an identifier of a WPI exchange (a request/response) between a client application and a payment application. Is used to recover the status of the exchange in case of an unexpected failure. Is provided by the client and should be part of the response. The session id : · must be unique · must be part of the response · must not be reused for subsequent requests (as soon as the cache is expired this would not be an issue, so it is not necessary to keep track of it but as a general rule a unique random string per request should be used) In the case of an unexpected failure during an exchange, the session id can be used in order for the client to restore its state and sync the exchange status with the payment application. |

String |

Mandatory |

Response

Extra |

Description |

Type |

Condition |

|---|---|---|---|

WPI_SERVICE_TYPE |

Specify the subtype of action to be executed |

String |

Mandatory |

WPI_RESPONSE |

The response contains JSON structure data processed for the requested service type |

String |

Mandatory |

WPI_VERSION |

Used WPI version |

String |

Mandatory |

WPI_SESSION_ID |

Identifier of a WPI exchange provided by the client |

String |

Mandatory |

The transaction request fields and examples per transaction type are explained in the subsequent sections:

/** Code snippet only

* SaleTransactionRequest and SaleTransactionResponse are not provide they are simple POJOs

*

*

*/

class SaleActivity: AppCompatActivity() {

val launcher = registerForActivityResult(

ActivityResultContracts.StartActivityForResult()

) { result ->

result.data?.let { handleTransactionResponse(it) }

}

private fun startTransactionIntent(transactionJson : String, serviceType : String) {

val intent = Intent("com.worldline.payment.action.PROCESS_TRANSACTION")

// These extras are mandatory whether the intent comes from the payment

// application or a 3rd party application.

intent.putExtra("WPI_SERVICE_TYPE", serviceType )

intent.putExtra("WPI_REQUEST", transactionJson )

intent.putExtra("WPI_VERSION", "2.1")

intent.putExtra("WPI_SESSION_ID",currentSession)

launcher.launch(intent)

}

private fun handleTransactionResponse(intent: Intent) {

val rawJsonResponse = intent.getStringExtra("WPI_RESPONSE")

// Handle response

}

}As you can see in the above example, the transaction request is sent to the payment application as JSON. The final result of the transaction is returned from the intent started previously and needs to be handled based on the service type. The JSON format is described in chapter 3.

There are some important considerations:

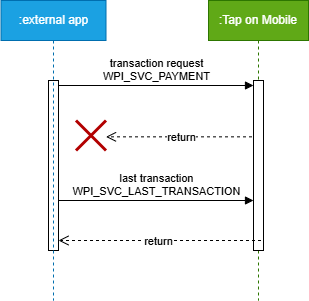

It is strictly advised to store WPI_SESSION_ID within the business application

No new transaction should be initiated before the result of the previous is known

If the previous transaction status is unknown to the cash register, last transaction should be used to get it from Tap on Mobile app

3. Data Dictionnary

This chapter describes the data exchange format, all requests and responses are described here. WPI is using JSON as data exchange.

3.1 Service Type

Service Type |

Description |

|---|---|

WPI_SVC_PAYMENT |

Service type for a purchase |

WPI_SVC_CANCEL_PAYMENT |

Service type for a reversal of a previous transaction |

WPI_SVC_REFUND |

Service type for a refund of a previous transaction |

3.2 Transaction Data

3.2.1 Purchase

The Service Type for a purchase transaction is WPI_SVC_PAYMENT . At minimum the currency and requestedAmount is needed.

Field Name |

Description |

Type |

Condition |

|---|---|---|---|

Currency |

Currency of the amount. Alpha code value defined in ISO 4217 (e.g. EUR) |

String |

Mandatory |

RequestedAmount |

Total payment amount as minor unit. The fractional digits are evaluated based in the currency. For example, 11.91€ must be sent as 1191 and the currency as EUR.

(tip amount is excluded) |

Integer |

Mandatory |

tipAmount |

The tip amount to be used as minor unit. This amount has the same currency as the transaction amount. |

Integer |

Optional |

Reference |

Reference to be send to the payment solution for reconciliation |

String |

Optional Due to the limitation of acquiring systems, only following characters are supported: ('a'..'z', 'A'..'Z', '0'..'9', hex 40 - hex FF) |

ReceiptFormat |

Array |

Optional |

{

"currency": "EUR",

"requestedAmount": 1022,

"reference": "myRef_01",

}3.2.1.1 TIP handling

TIP functionality has to be enabled in Tap on Mobile portal on every terminal by checking the field “TIP Enabled”

In case of tipAmount in the WPI request is not defined and TIP is enabled => Tap on Mobile app will show the tip entry screens.

In case of tipAmount in the WPI request is defined > 0 and TIP is enabled => Tap on Mobile will take the tip amount from the request and not show the tip entry screen

In case of tipAmount is null or 0 => ToM will not show the tip entry screen and no tip will be processed as part of given transaction

3.2.2 Reversal/Cancellation

The Service Type for a reversal transaction is WPI_SVC_CANCEL_PAYMENT . To reverse a transaction, you need the paymentSolutionReference you retrieve in the response of the transaction that shall be reversed.

Field Name |

Type |

Condition |

|---|---|---|

PaymentSolutionReference |

String |

Mandatory |

Reference |

String |

Optional Due to the limitation of acquiring systems, only following characters are supported: ('a'..'z', 'A'..'Z', '0'..'9', hex 40 - hex FF) |

receiptFormat |

Array |

Optional |

{

"paymentSolutionReference": "PaymentSolRef-013543-22234;kjhj3ll3jJHGGSk",

"reference": "myRef_01"

}Remark:

It is possible to reverse only last Payment transaction

Reversal does not need a card tapping - the full amount will be reversed to the card that initiated the Transaction

3.2.3 Refund

The Service Type for a refund transaction is WPI_SVC_REFUND . A refund transaction is like a reversal but just for a partial amount. That means the requestedAmount specified needs to be equal or lower than the original one. The paymentSolutionReference is the one of the original (previous) transaction that shall be refunded.

Field Name |

Type |

Condition |

|---|---|---|

currency |

String |

Mandatory |

requestedAmount |

Integer |

Mandatory |

paymentSolutionReference |

String |

Mandatory |

reference |

String |

Optional Due to the limitation of acquiring systems, only following characters are supported: ('a'..'z', 'A'..'Z', '0'..'9', hex 40 - hex FF) |

receiptFormat |

Array |

Optional |

{

"currency": "EUR",

"requestedAmount": "399",

"paymentSolutionReference": "PaymentSolRef-013543-22234-kjhj3ll3jJHGGSk",

"reference": "myRef_01"

}Remarks:

It is possible to refund Payment transaction that is not reversable (all but the last one)

Refund requires card tapping

3.3 For transactions with multiple items or services, it is possible to process only one refund (for total or partial amount) Information

Retrieval of Payment Solution specific information that does not require user interaction. The request does not contain any parameter.

3.3.1 Last Transaction

In case of the last payment transaction response is not known any more it can be requested by this service. It will return the last financial transaction response independent of the result, failed or success. This is a recovery feature as the payment solution will remember the last SESSION_ID as well as corresponding transaction response. The Android Extras are close to a standard transaction response except for the conditional presence of WPI_SERVICE_TYPE & WPI_RESPONSE. An initial check on one of these extra properties can provide information about the existence of the session.

Be aware any payment solution will just store the last response. That implies that no other WPI request shall be done before the recovery.

Request:

Extra |

Description |

Type |

Condition |

|---|---|---|---|

WPI_SERVICE_TYPE |

WPI_SVC_LAST_TRANSACTION |

String |

Mandatory |

WPI_VERSION |

Used WPI version |

String |

Mandatory |

WPI_SESSION_ID |

The session id of the requested session NOT a new session id |

String |

Mandatory |

Response

Extra |

Description |

Type |

Condition |

|---|---|---|---|

WPI_SERVICE_TYPE |

This will be the service type of the recovered transaction not "WPI_SVC_LAST_TRANSACTION" |

String |

Conditional Mandatory if Session id known by the payment solution and transaction was executed (failure or success) |

WPI_RESPONSE |

The Financial Payment Response object of the corresponding SESSION_ID |

String |

Conditional Mandatory if Session id known by the payment solution and transaction was executed (failure or success) |

WPI_VERSION |

Used WPI version |

String |

Mandatory |

WPI_SESSION_ID |

Identifier of a WPI exchange, this session id will be the same as the one sent in the request |

String |

Mandatory |

3.3.1.1 Receipt Format

Value (String) |

Purpose |

Tap on Mobile app behavior |

|---|---|---|

FORMATTED |

Return the receipt in a payment response as String (default) |

No confirmation/receipt details screen after completing transaction; FormattedReceipt contains all the data |

JSON |

Return the receipt in a payment response as JSON |

No confirmation/receipt details screen after completing transaction; Receipt field contains json data |

EMPTY ARRAY |

The payment solution provides the receipt as configured in TMS. Depending on the device this can be printed or QR Code based. |

Confirmation/receipt details screen is displayed after completing transaction; no receipt data sent back to ECR application |

Default is formatted. If an empty array is sent no receipt will be returned nor provided by the payment app.

3.4 Transaction response description

Each financial transaction has a minimum set of fields that needs to be there per service type. In the subsequent chapters this is described in detail.

The response contains the following fields.

Field name |

Description |

Type |

Condition |

|---|---|---|---|

Result |

Result of the transaction (success or failure) |

String |

Mandatory |

ErrorCondition |

Specific error reason (see table below) |

String |

Mandatory |

Remark |

Terminal / transaction specific message for detailed error descriptions. Text provided by payment app in English |

String |

Conditional - only for NOT successful transaction |

Action Code |

String |

Conditional - only for successful transaction |

|

Timestamp |

Date and time of the transaction, indicated by the acquirer Format according to ISO 8601 |

String (ISO 8601) |

Conditional - only for successful transaction |

Currency |

Currency code of the transaction. Alpha code value defined in ISO 4217 e.g. EUR |

String |

Conditional - only for successful transaction |

AuthorizedAmount |

Amount of the transaction. The fraction is taken from the currency code. Example: Currency = EUR requestedAmount = 3190 => 31,90 € |

String |

Conditional - only for successful transaction |

BrandName |

Brand name of used payment method as described in the 3.4.4 |

String |

Conditional - only for successful transaction in which a payment card was used |

CustomerLanguage |

Language the payment application shall use. If the language is not supported by the payment application the default language of the terminal will be used.

used on all screens towards the cardholder and when formatting the receipt. Language code will be returned for english > en

Format according to ISO 630-1 (alpha-2 code) |

String |

|

ApplicationIdentifier |

Payment card application identifier dependent on the used card e.g. for MasterCard A00000041010 |

String |

Conditional - only for successful transaction in which a payment card was used |

ApplicationLabel |

Payment card application label, depending on the used card e.g. MasterCard DEBIT |

String |

Conditional - only for successful transaction in which a payment card was used |

Receipt |

Details for the Receipt Object are described in the 3.4.5 |

Object |

Conditional:

|

PaymentSolutionReference |

Transaction specific and unique identification. This value is defined by the payment application and contains all necessary data to perform subsequent transactions. This value can differ based on the payment application and can only be used on the same device. |

String |

Conditional:

|

Reference |

Reference to be send to the payment app for reconciliation |

String |

Optional - available in case of a reference was provided in the request |

acquirerIdentifier |

Identifier for the acquirer |

String |

Conditional:

|

merchantIdentifier |

String |

Mandatory |

|

terminalIdentifier |

String |

Mandatory |

|

authorizationCode |

The first 2 digits of this element will correspond to the ISO response code. The structure would be XX ABCDEF where XX is the ISO response code and ABCDEF the acquirer authorisation code for successful transactions |

String |

Conditional in case transaction was processed online |

tipAmount |

Integer |

Conditional - in case of tip is active and entered by the cardholder during transaction processing or provided in the request |

|

dccUsed |

|||

dccOffered |

|||

dccAmount |

|||

dccCurrency |

|||

dccExchangeRate |

|||

authorizationMode |

Pre-defined values described in 3.4.6 Authorisation mode |

String |

Conditional - in case of successful transaction |

pan |

Truncated PAN with last 4 digits |

String |

Conditional - in case of successful transaction |

cardholderVerificationMethod |

String |

Conditional - in case of successful transaction |

|

cardDataInput |

String |

Conditional - in case of successful transaction |

3.4.1 Result

Result |

Description |

|---|---|

WPI_RESULT_SUCCESS |

In case of successful transaction |

WPI_RESULT_FAILURE |

In case of failed transaction |

3.4.2 Error Conditions

Error Condition |

Description |

|---|---|

WPI_ERR_COND_NONE |

Will always be present if no error occurred |

WPI_ERR_COND_SERVICE_NOT_SUPPORTED |

The requested service type is not supported by the Payment Application/Service |

WPI_ERR_COND_ABORTED |

The initiator of the request has sent an abort request, which was accepted and processed |

WPI_ERR_COND_BUSY |

The Payment Application/Service is busy. Try later |

WPI_ERR_COND_CARD_READ_ERR |

The payment application was not able to read the card. Either due to inconsistent data or wrong card handling |

WPI_ERR_COND_USER_CANCEL |

The user has aborted the transaction |

WPI_ERR_COND_USER_TIMEOUT |

A timeout occurred while waiting for user interaction |

WPI_ERR_COND_HOST_REFUSAL |

The Acquirer/Issuer refused the transaction |

WPI_ERR_COND_NETWORK_ISSUE |

Network issue occurred (host not reachable, network down, … ) |

WPI_ERR_COND_TRANSACTION_TIMEOUT |

Timeout occurred during transaction (other than with user interaction) |

WPI_ERR_COND_ENCRYPTION_ISSUE |

Encryption issue (PAN, PIN …) caused the transaction to be aborted |

WPI_ERR_COND_ INVALID_KEY |

The secure component of the terminal is missing a key it needs to perform the transaction |

WPI_ERR_COND_INVALID_TRANSACTION_REQ |

Invalid transaction request received. One of the fields in the transaction request object was invalid |

WPI_ERR_COND_INTERNAL |

Internal error within payment service |

WPI_ERR_COND_INVALID_AMOUNT |

Entered invalid amount |

WPI_ERR_COND_INVALID_CURRENCY |

Transaction started with invalid currency. The currency is a global attribute of the underlying payment service |

WPI_ERR_COND_APP_NOT_SUPPORTED |

None of the applications on the EMV NFC/IC chip card are accepted or the ISO/PAN on the magnetic stripe track didn’t result in a brand being accepted |

WPI_ERR_COND_MISSING_MANDATORY_PARAMETER |

A mandatory parameter is missing in the request |

WPI_ERR_COND_GENERIC |

A generic error that is not specified in detail |

WPI_ERR_COND_WPI_VERSION_NOT_SUPPORTED |

The request contains a WPI version which is not supported by the payment solution |

WPI_ERR_COND_SESSION_ID_ALREADY_IN_USE |

In case of the SESSION ID was already used and the payment solution would not be able to identify the last transaction for recovery then this error code is returned |

WPI_ERR_COND_INVALID_PASSWORD |

For password protected transactions, this error code is returned if the password entered in the payment solution, by the merchant, is incorrect |

WPI_ERR_COND_RECEIPT_DELEGATION_NOT_SUPPORTED |

If a transaction was started with receipt delegation and receipt delegation is not supported this error code is returned |

WPI_ERR_COND_MANUAL_PAN_KEY_ENTRY_NOT_SUPPORTED |

In case of manual PAN key entry is not possible but requested |

WPI_ERR_COND_TIP_NOT_SUPPORTED_BY_PAYMENT_SOLUTION |

If tipAmount is present in the transaction request but not supported by the payment solution |

WPI_ERR_COND_TIP_NOT_SUPPORTED_BY_SERVICE_TYPE |

If tipAmount is present in the transaction request but not supported for the specific service type |

WPI_ERR_COND_TIP_NOT_SUPPORTED_BY_BRAND |

If tipAmount is present in the transaction request but not supported by cardholder card brand |

WPI_ERR_COND_TIP_AMOUNT_EXCEEDS_MAXIMUM |

If tipAmount is higher than the maximum allowed tipAmount configured for the payment solution |

3.4.3 Action Codes

Action Codes |

Description |

|---|---|

WPI_ACTION_CODE_NONE |

No additional action to be performed |

3.4.4 Brand Name

Mapping should be based on Payment Application configuration returned by Acquirer. If not possible to find the right match (for e.g. brand is not specified or Payment Solution does not know what brand was used) WPI_BRAND_NAME_OTHER value shall be returned. In case of local brands, WPI_BRAND_NAME_LOCAL_DEBIT_CARD or WPI_BRAND_NAME_LOCAL_CREDIT_CARD shall be returned.

Brand Name |

|---|

WPI_BRAND_NAME_ALIPAY |

WPI_BRAND_NAME_AMERICAN_EXPRESS |

WPI_BRAND_NAME_BANCONTACT |

WPI_BRAND_NAME_BLIK |

WPI_BRAND_NAME_CARTE_BANCAIRE |

WPI_BRAND_NAME_GIROCARD |

WPI_BRAND_NAME_LOCAL_CREDIT_CARD |

WPI_BRAND_NAME_LOCAL_DEBIT_CARD |

WPI_BRAND_NAME_LOCAL_QR_CODE_BRAND |

WPI_BRAND_NAME_MAESTRO |

WPI_BRAND_NAME_MASTERCARD |

WPI_BRAND_NAME_MASTERCARD_DEBIT |

WPI_BRAND_NAME_OTHER |

WPI_BRAND_NAME_PAYCONIQ |

WPI_BRAND_NAME_TWINT |

WPI_BRAND_NAME_VISA |

WPI_BRAND_NAME_VISA_DEBIT |

WPI_BRAND_NAME_VISA_ELECTRON |

WPI_BRAND_NAME_VPAY |

WPI_BRAND_NAME_WECHAT_PAY |

3.4.5 Receipt

Field name |

Description |

Type |

|---|---|---|

Formatted |

Merchant and cardholder receipt are contained in this field. Both receipts are available as text preformatted. The receipt wide is defined by the payment application (often 32 characters) and depends on the printer capabilities or configuration. |

JSON object (check example below) |

Json |

Merchant and cardholder receipt are contained in this field. Both receipts are represented in a JSON format. This is used to create a own format. (warning) An own format should be compliant with the local, payment solution and EMV specification! |

JSON object (check example below) |

3.4.6 Authorisation Mode

Authorization Mode |

Description |

|---|---|

WPI_AUTHORIZATION_MODE_ONLINE |

Authorized online |

3.4.7 Cardholder Verification Method

Cardholder Verification Method (CVM) |

Description |

|---|---|

WPI_CVM_NO_CVM |

No CVM executed |

WPI_CVM_PIN_ONLINE |

PIN online CVM executed |

WPI_CVM_CD_CVM |

Consumer Device CVM |

3.4.8 Card Data Input

Card Data Input |

Description |

|---|---|

WPI_CARD_DATA_INPUT_ALTERNATIVE_PAYMENT_METHOD |

Card data was provided through an alternative payment method (e.g. QR Code payment) |

WPI_CARD_DATA_INPUT_PROXIMITY_ICC |

Card data was read via NFC with chip mode |

WPI_CARD_DATA_INPUT_PROXIMITY_MAGNETIC_STRIPE |

Card data was read via NFC with magnetic stripe mode |

WPI_CARD_DATA_INPUT_REFERENCE_BASED |

Card data evaluated by the acquiring system from a previous (referenced) transaction |

3.5 Sample transaction receipt

Tap on Mobile application has its own transaction receipt handling and it supports:

Sending it via email

Generating QR Code with the link to the digital receipt on the server

However, each response contains a transaction receipt for merchants and cardholders. The below example shows a pretty printed version of the JSON you will receive - for demonstration purpose as usually each receipt content is in one line. As it is written in the JSON specification ( https://www.ietf.org/rfc/rfc4627.txt ) every control character has to be escaped like shown below but on the same line.

"formatted":{

"merchant":" This is to confirm your transaction\\n

registered at:\\n

----------------------------------------\\n

SPS-Softpos Pilot 02\\n

Grzybowska 4/246\\n

00-131 Warszawa\\n

----------------------------------------\\n

15.02.2023 22:36\\n

0,03 PLN\\n

Visa **** **** **** 7984\\n

Transaction details: \\n

Status: AUTHORIZED\\n

Authorization code: (0) 741451\\n

ARQC: 61BC5EDC34F63979\\n

AID: A0000000031010\\n

Contactless\\n

Type: Sale\\n

POS ID: APP00002\\n

MID: 103810047\\n

VISA CARD",

"client":" This is to confirm your transaction\\n

registered at:\\n

----------------------------------------\\n

SPS-Softpos Pilot 02\\n

Grzybowska 4/246\\n

00-131 Warszawa\\n

----------------------------------------\\n

15.02.2023 22:36\\n

0,03 PLN\\n

Visa **** **** **** 7984\\n

Transaction details: \\n

Status: AUTHORIZED\\n

Authorization code: (0) 741451\\n

ARQC: 61BC5EDC34F63979\\n

AID: A0000000031010\\n

Contactless\\n

Type: Sale\\n

POS ID: APP00002\\n

MID: 103810047\\n

VISA CARD"

}{

"json":{

"receiptTargets":{

"merchant":{

"description": List of field names of the receipt to be included for the merchant receipt

"type":"array",

"items":{

"type":"string"

}

},

"client":{

"description": List of field names of the receipt to be included for the client receipt

"type":"array",

"items":{

"type":"string"

}

}

},

"duplicate":{

"type":"boolean"

},

"shopInfo":{

"name":{

"type":"string"

},

"address":{

"type":"string"

},

"zipCode":{

"type":"string"

},

"city":{

"type":"string"

},

"country":{

"type":"string"

},

"logo":{

"type":"string" // Content provider uri to the logo file

}

},

"terminalIdentifier":{

"type":"string"

},

"period":{

"type":"string"

},

"transactionIdentifier":{

"type":"string"

},

"currency":{

"type":"string"

},

"amount":{

"type":"integer"

},

"token":{

"type":"string"

},

"par":{

"type":"string"

},

"brandName":{

"type":"string"

},

"applicationIdentifier":{

"type":"string"

},

"issuerName":{

"type":"string"

},

"pan":{

"type":"string"

},

"maskedpan":{

"type":"string"

},

"cardSequence":{

"type":"string"

},

"cardExpiration":{

"type":"string"

},

"serviceName":{

"type":"string"

},

"timeStamp":{

"type":"string"

},

"authorizationCode":{

"type":"string"

},

"reference":{

"type":"string"

},

"acquirerIdentifier":{

"type":"string"

},

"cardDataInput":{

"type":"string"

},

"cardholderVerificationMethod":{

"type":"string"

},

"legalIdentificationRequired":{

"type":"boolean"

},

"cardBalance":{

"old":{

"type":"string"

},

"new":{

"type":"string"

},

"cardholderText":{

"type":"string"

}

},

"paymentSolutionReference":{

"type":"string"

},

"operatorIdentifier":{

"type":"string"

},

"cardholderReceiptText":{

"type":"string"

},

"acquirerReceiptText":{

"type":"string"

},

"footerLines":{

"type":"array",

"items":{

"line":{

"type":"string"

}

}

},

"additionalData":{

"type":"array",

"items":{

"key":{

"type":"string"

},

"value":{

"type":"dynamic"

}

}

}

}

}